CoinPayments is a cryptocurrency gateway offering crypto payment solutions for businesses and individuals. As part of our ongoing commitment to business and client safety procedures and legal compliance, we require businesses to partake in KYB (Know Your Business). KYB is mandatory and ensures CoinPayments complies with financial regulations and reduces risks to its clients.

KYB involves verifying the identity of business entities, assessing their reputation, and evaluating potential risks. By conducting KYB checks, businesses can protect themselves against financial losses, legal penalties, and reputational damage.

We’ve partnered with leading verification platforms, such as SumSub and RiskScreen, which are trusted by leading financial institutions globally, to ensure data safety and privacy. These platforms are fully compliant with GDPR and other data protection regulations, ensuring that your information is in safe hands.

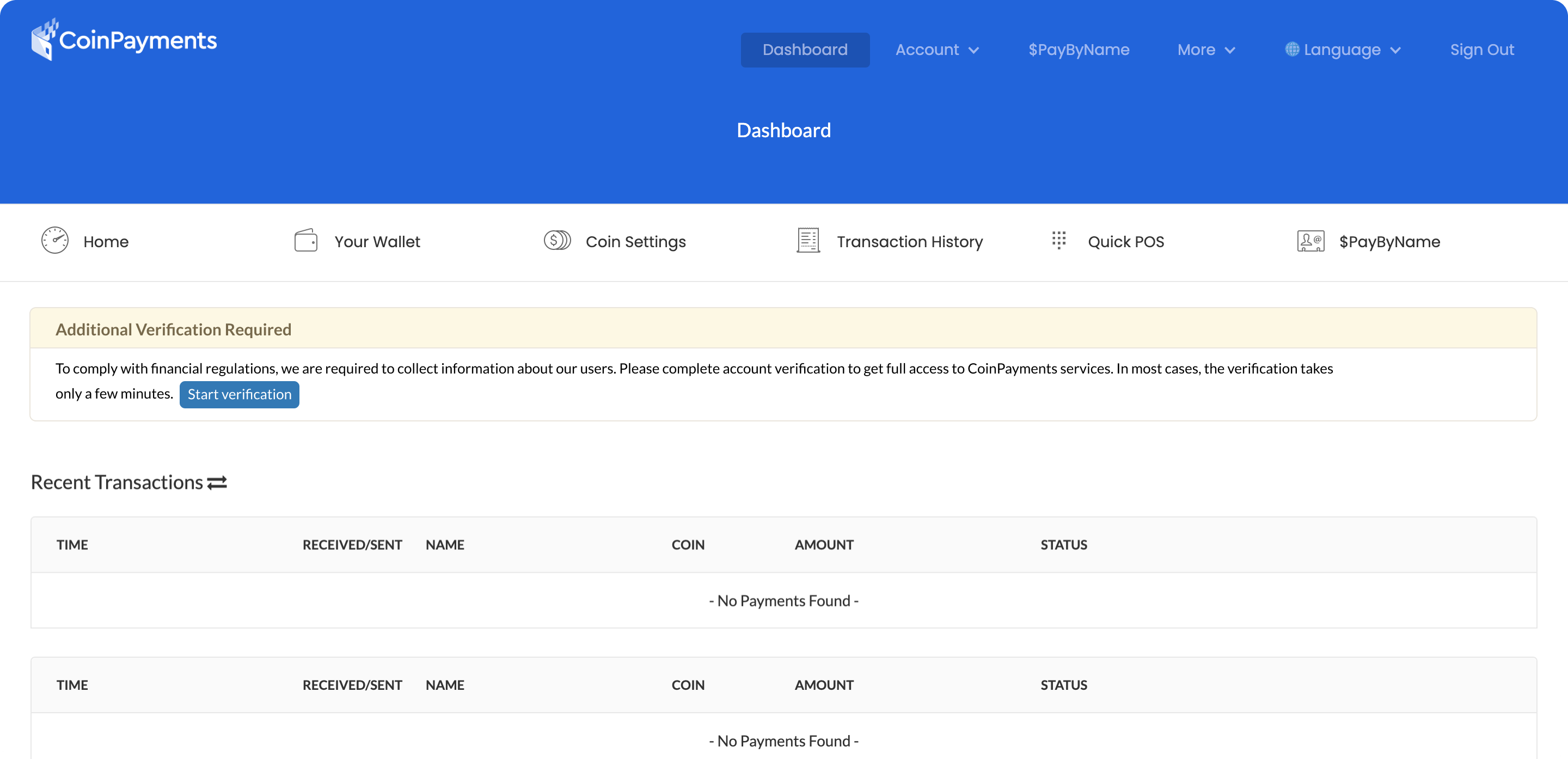

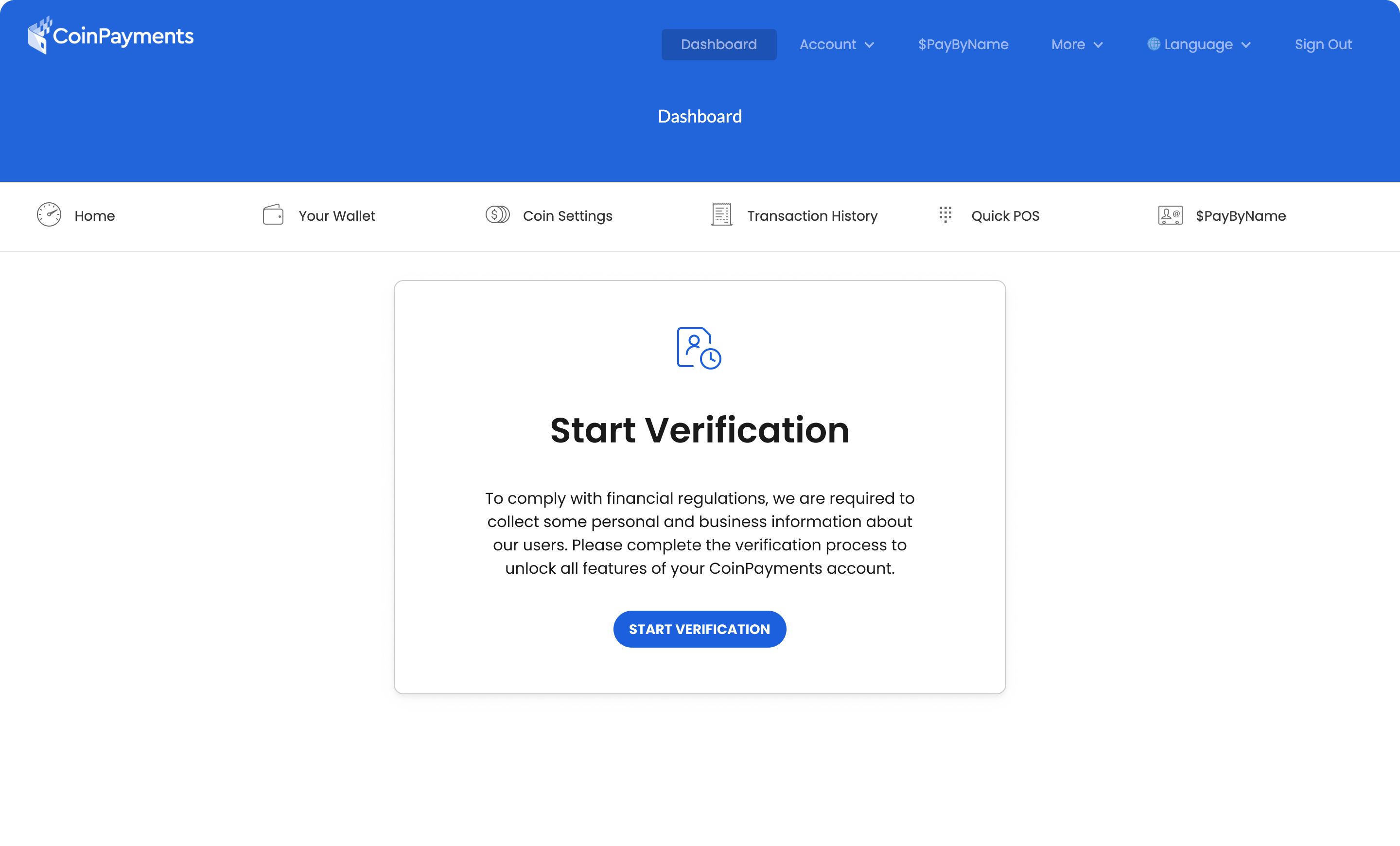

CoinPayments uses KYB to ensure that businesses using its platform are legitimate and safe. After creating an account, the verification process can be initiated by selecting START VERIFICATION.

There are two primary KYB pathways with CoinPayments:

Let’s dive in!

First, sign up for a CoinPayments account and select Start Verification to provide the necessary details.

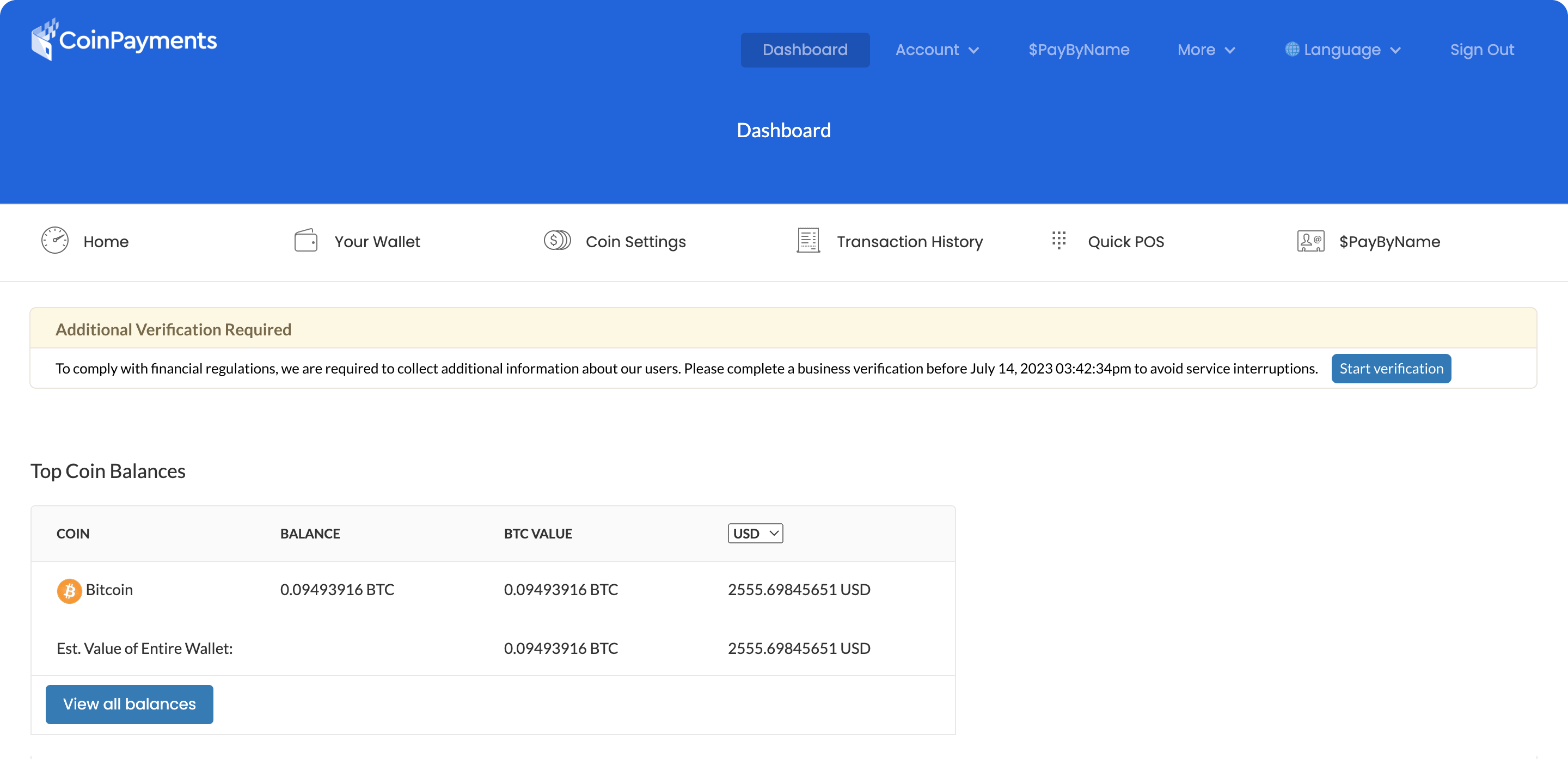

Having created your account, the Account Verification Required prompt will be displayed on all dashboard pages. Clicking the banner confirmation button will direct you to Step 2.

You can test the payment processes using the Litecoin Testnet (LTCT) virtual asset. LTCT is a demo asset allowing users to test the application functionality. Users can simulate withdrawals, deposits and test their APIs using the asset.

Other assets will be unavailable until the KYC/KYB verification process is complete.

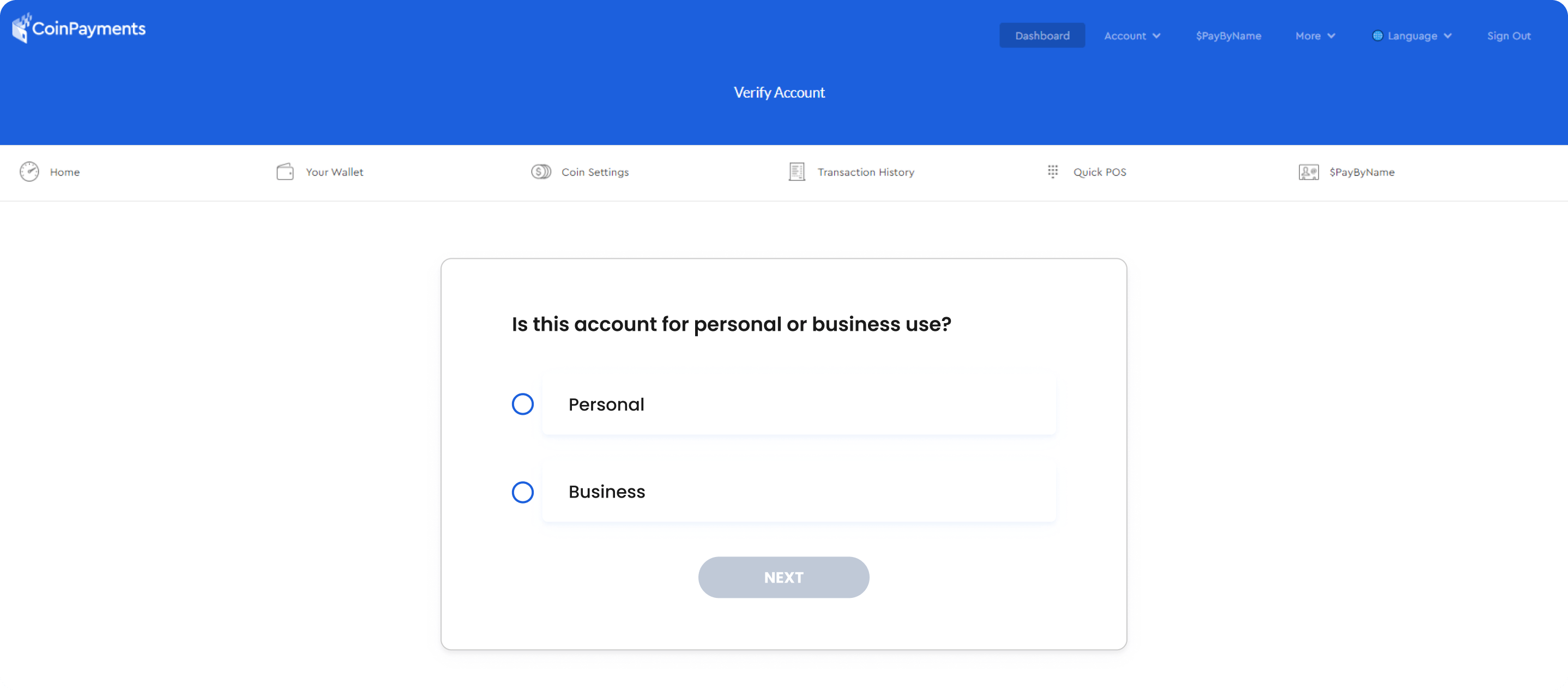

Once the verification is started, you must choose between a Business and a Personal account.

Choose between a Personal or Business account.

When selecting the Personal account option, a confirmation prompt will appear.

The following steps are explained in the KYC blog.

The Business account registration process is described below.

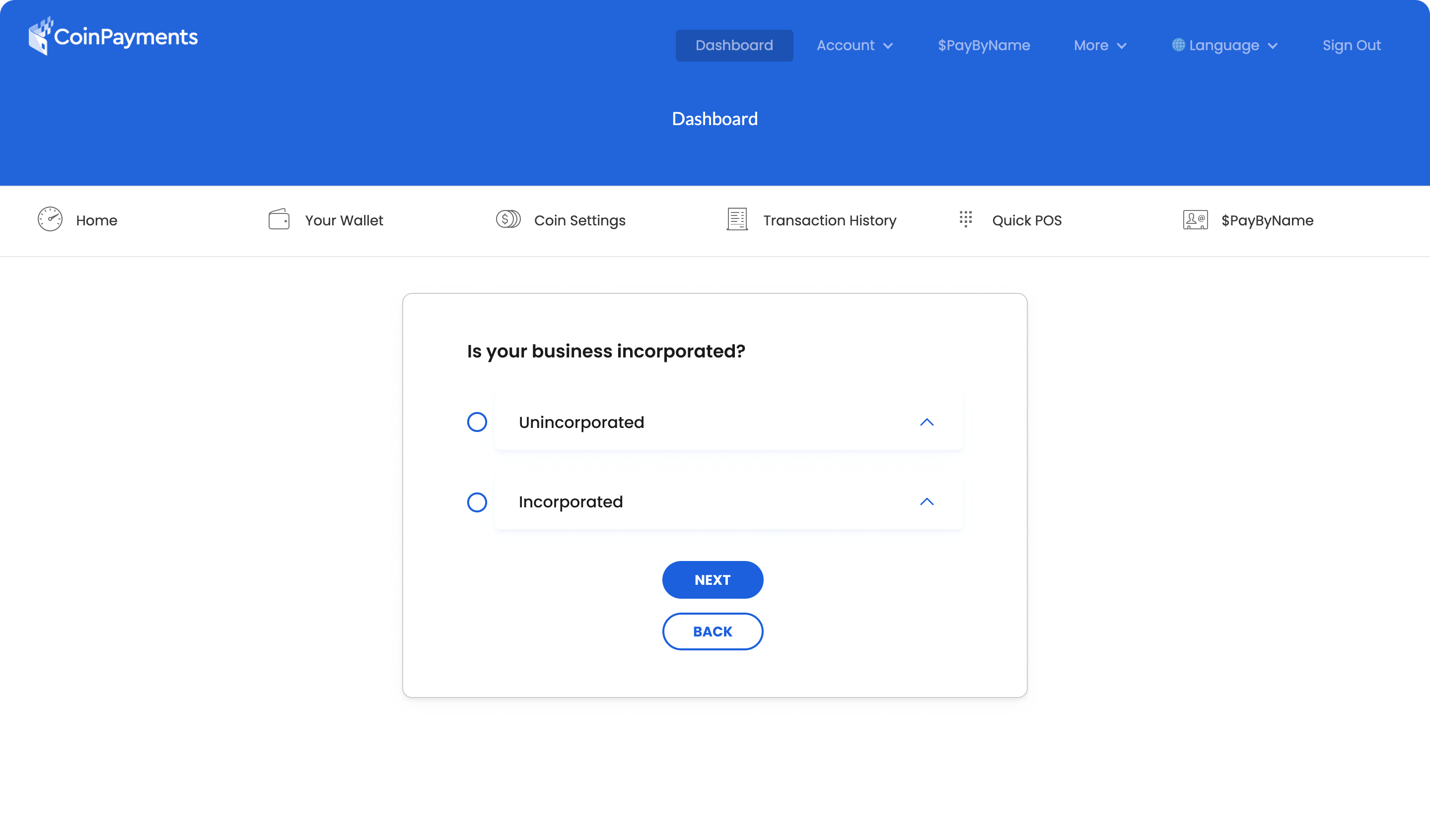

Choose your business type (incorporated or unincorporated) and complete the KYB application.

One of the key distinctions between the two is that non-incorporated companies are owned by individuals who are personally liable for debts. The verification requirements for such accounts are the same as for Personal accounts and can be found in the KYC blog.

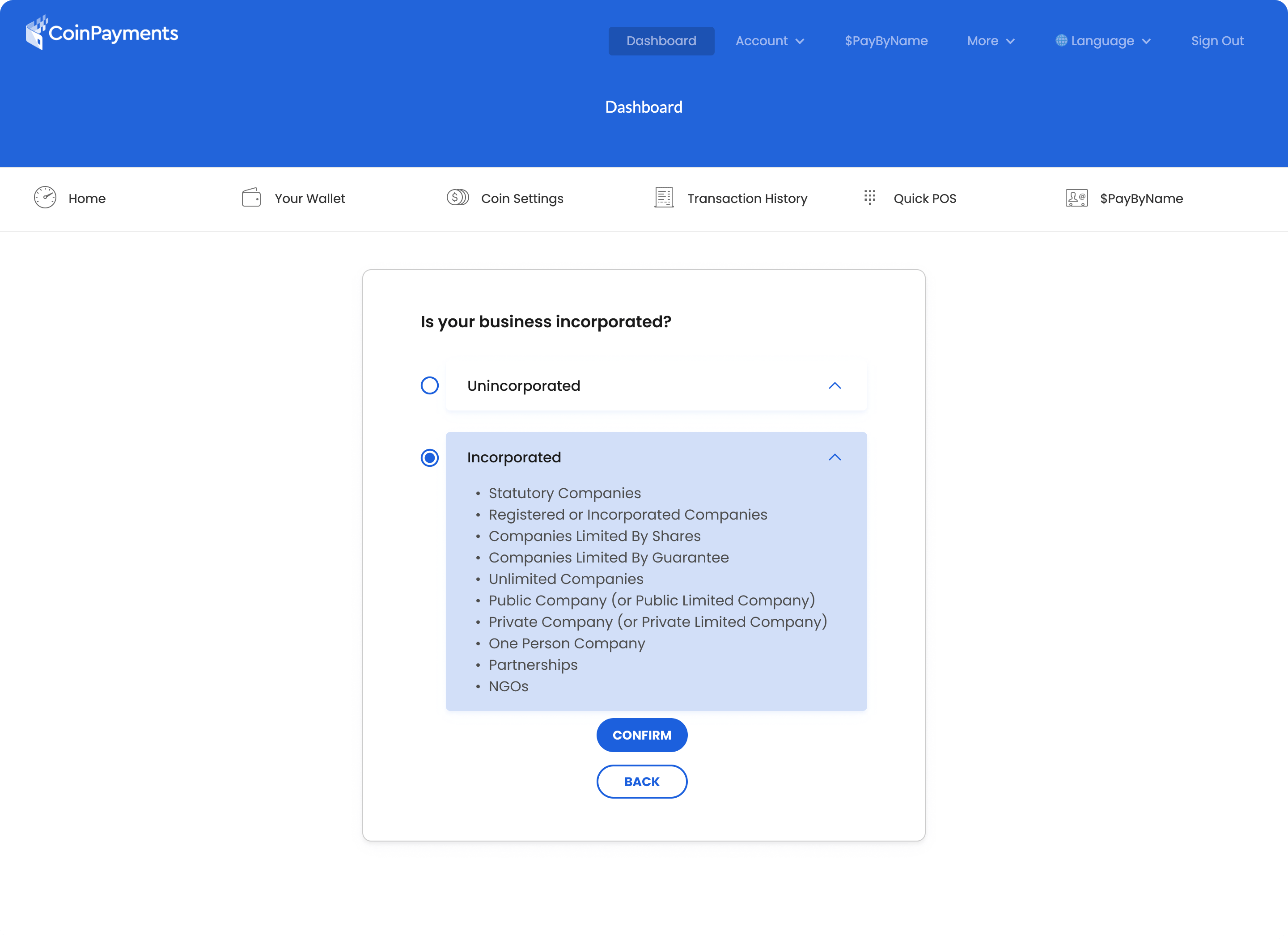

Incorporated companies, such as statutory companies, limited companies (public or private), one-person companies, partnerships, and NGOs, offer protection against liabilities as separate legal entities from their owners.

The business type options are displayed as shown in the image below:

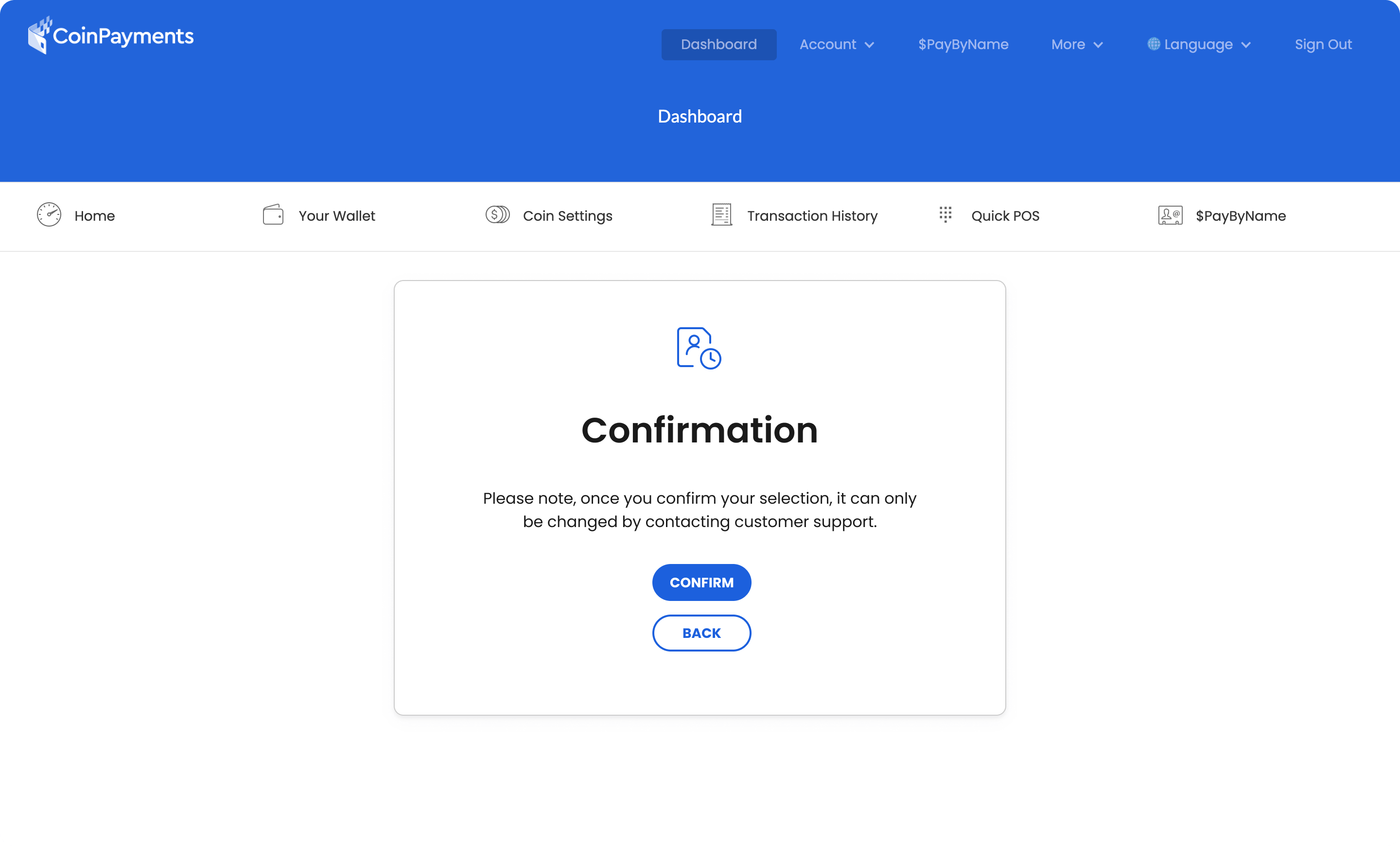

Once you choose the appropriate option, a CONFIRMATION SCREEN will be displayed as shown below. Only the customer support team can modify your selection of the business type once it is submitted.

Click “START VERIFICATION” to verify the company details as below.

After choosing the appropriate option, you’ll be redirected to our partner platforms for company verification.

START VERIFICATION for “Non-Incorporated” merchants will direct you to our partner (SumSubstance platform) for company verification, identical to the KYC process for personal accounts.

START VERIFICATION for “Incorporated” merchants will redirect you to our partner (RiskScreen platform) to perform company verification.

Wait for a unique verification code to be sent to your email.

After receiving the verification code from your registered email, provide the required general, personnel, business, and financial information, including details of directors and ultimate beneficial owner(s).

Disclose political exposure and complete KYC steps for each Director or UBO.

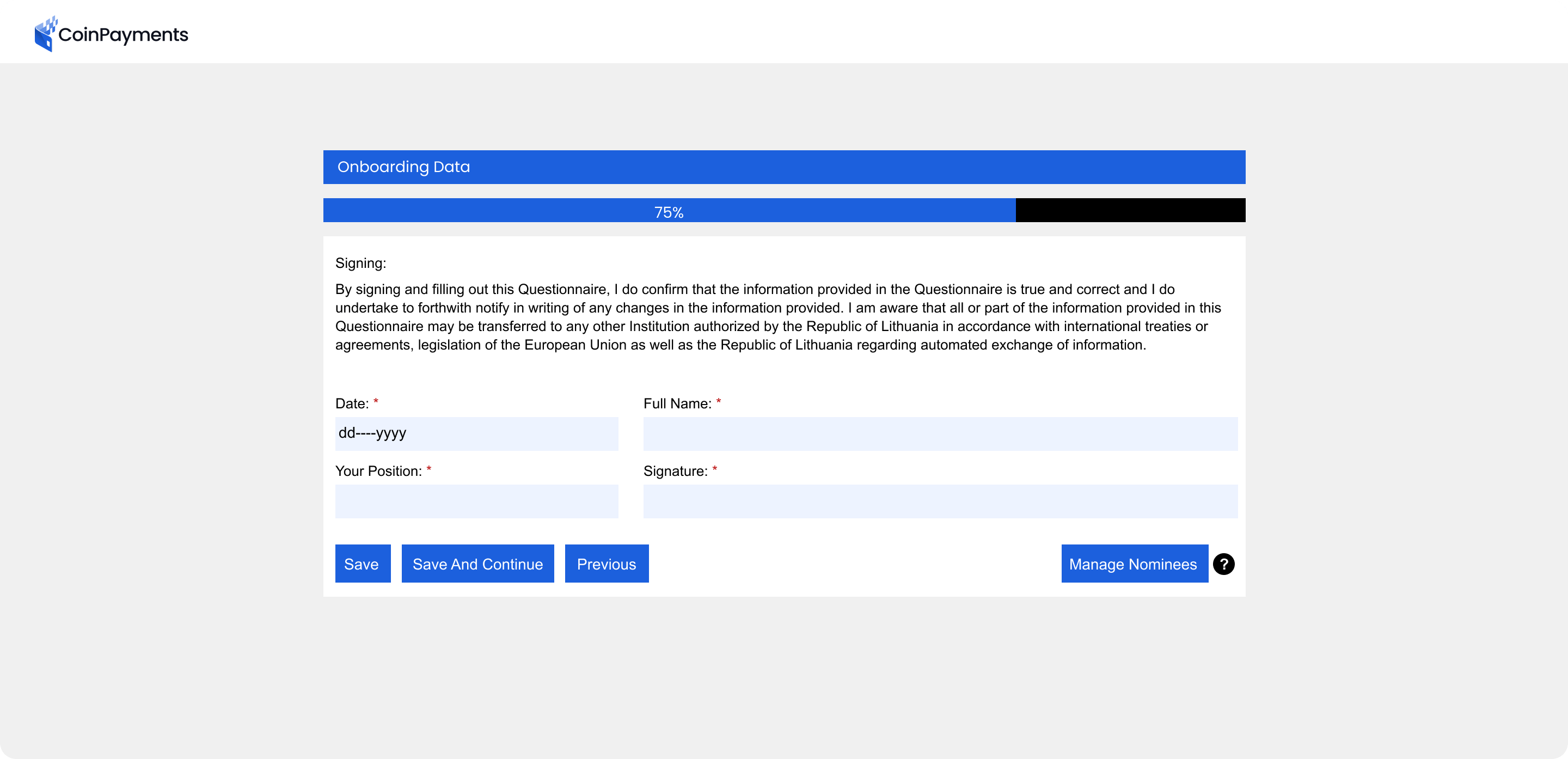

Sign to confirm the data submitted by your company/team is authentic.

Upload valid documents that are no older than three months and in English.

For incorporated merchants, the required documents include Incorporation documents, Article of Association/Memorandum of Association and Extract from Trade Registry.

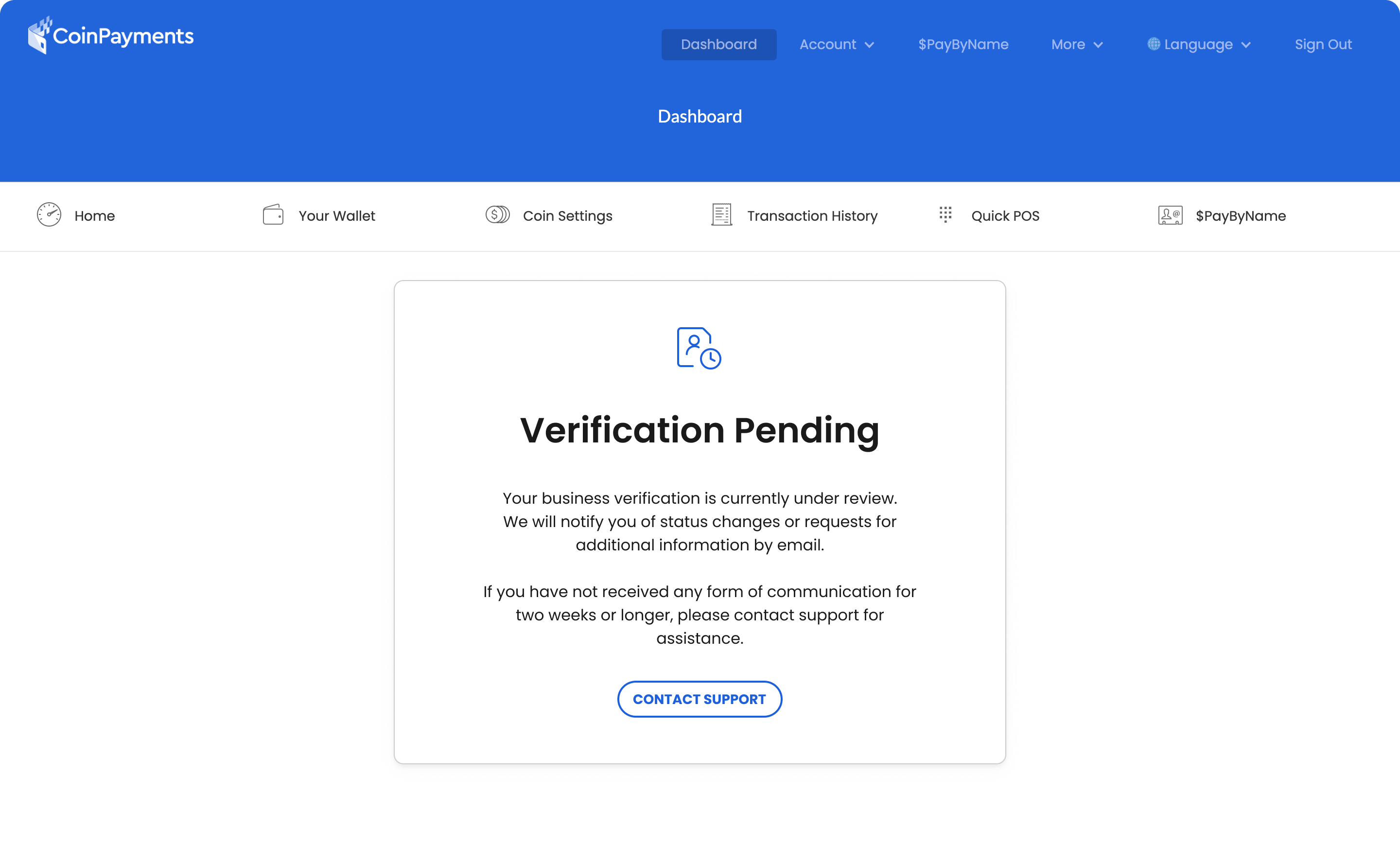

Your KYB application enters a processing period that may last up to 5 days. During this period, the company’s information will be reviewed, and a response will be given to you.

While waiting for confirmation, you can test the functionality of the application using the Litecoin Testnet (LTCT) demo asset, as outlined above.

After successful verification, you’ll receive an email notification confirming you have full access to all supported CoinPayments cryptocurrencies and features.

All features remain available for existing CoinPayments users with active grace periods until the grace period ends.

Here are the steps to follow to complete your KYB verification:

Follow steps 2 through 10 described in New Merchant Path – Business Step-by-Step Guide.

For personal and unincorporated accounts with completed identity verification, the previously provided information will be automatically carried over. Therefore, minimal additional verification (or none) will be necessary.

During this merchant review process, all account features remain available until the end of the grace period.

If you have any questions or concerns during the verification process, please contact the CoinPayments’ support team for assistance.

Once our Compliance team approves the application, all account features become accessible ✅

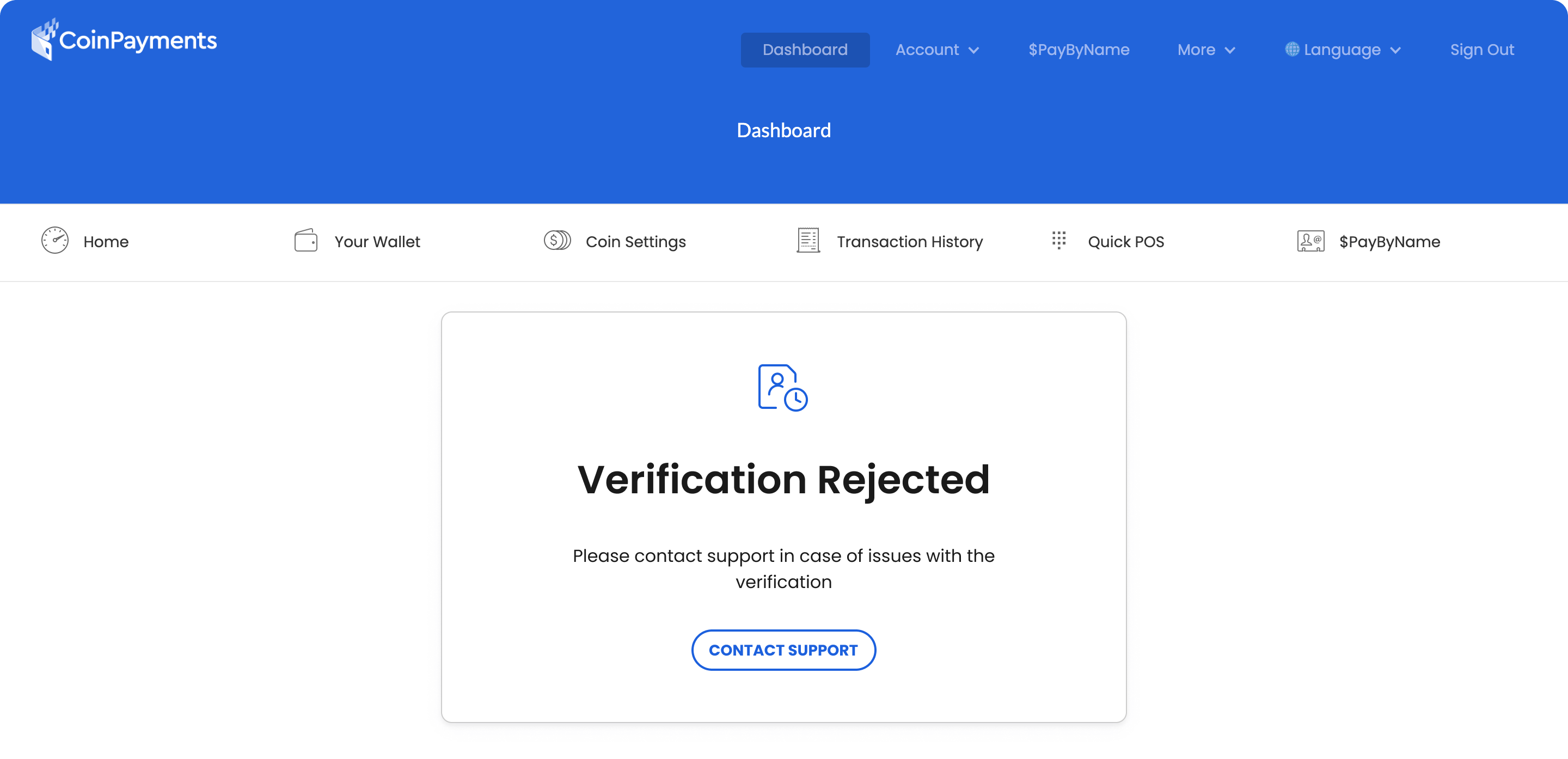

If the account is Rejected, the following banner will be displayed:

If you fall into the category of users who have an existing business account without KYB verification and have lost access to our services, follow the instructions for new merchants.

Upon completion of the steps outlined in this guide, your business will complete its KYB verification and enjoy full access to all CoinPayments’ features.