With the creation of Bitcoin in 2009, a radical new way of making payments emerged before our eyes: with decentralized digital currencies not controlled by any government, called cryptocurrencies.

Since then, the development of this new form of payment continues to be exponential, being accepted by large corporations such as Microsoft, Etsy, Twitch, PayPal, Whole Foods, and even between countries.

The entry of Bitcoin as legal tender in El Salvador, along with other important projects in the crypto ecosystem, made 2021 the year when cryptocurrencies became mainstream. As a result, interest in crypto payments has increased exponentially, both from big companies and small merchants around the world.

However, what is happening in 2022? How is the crypto payments market evolving compared to 2021? What cryptocurrencies do customers use to pay in stores? What digital currencies do merchants want to receive for their goods and services?

In this article, we will answer all these questions, sharing charts and reports based on CoinPayments data.

We will also show the 5 most used cryptocurrencies in transactions made through our crypto payment gateway, comparing the results of 2021 and 2022 to see their evolution.

At the end of the article, you will learn first-hand where cryptocurrency trends are moving, and you will understand why you should accept these digital currencies in your business.

Throughout 2021, the crypto payments sector has seen a major evolution. As you will see below, CoinPayments’ data shows that more and more people want to spend their cryptocurrencies in the same way they use their fiat currencies.

At the same time, both large brands and small merchants are capturing this new group of customers who want to pay with crypto.

As a result, more merchants are integrating crypto payments into their businesses, which are processing more volume and transactions with cryptocurrencies.

If we consider the total number of transactions processed by CoinPayments in 2021, we have had a slight decrease of 17.92% since the beginning of the year.

However, if we include the data for the first months of 2022 up to March, we can see how the number of transactions has increased by 32.52% since January 2021.

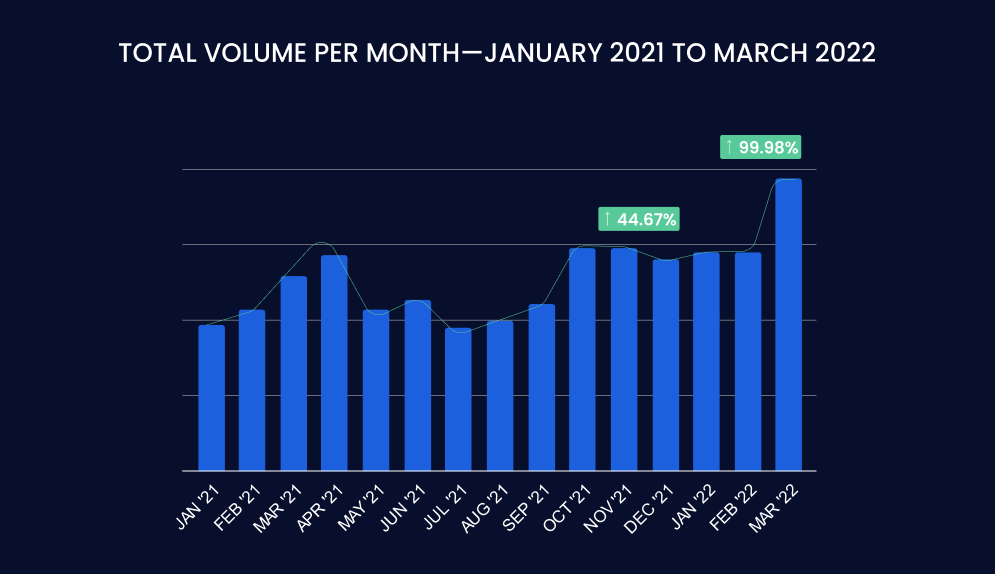

Total volume figures are on the same trend, both in 2021 and in the first quarter of 2022.

Despite month-on-month variations from the beginning to the end of 2021, the total volume processed by our platform has increased by 44.67%.

And if we take into account the first quarter of 2022, this growth rises to almost 100% (99.98% to be exact).

That is, from January 2021 to March 2022, the volume processed in crypto payments by CoinPayments doubled, confirming that crypto payments are on the rise.

The general perception of cryptocurrencies, among both consumers and businesses, seems to be shifting from being an asset class—similar to gold or bonds—to being a currency to spend.

Companies are moving quickly toward this new reality, using solutions such as CoinPayments gateway to facilitate payments with crypto.

Now, which cryptocurrencies are merchants accepting? Which coins do consumers prefer to pay with?

Let our data speak for itself.

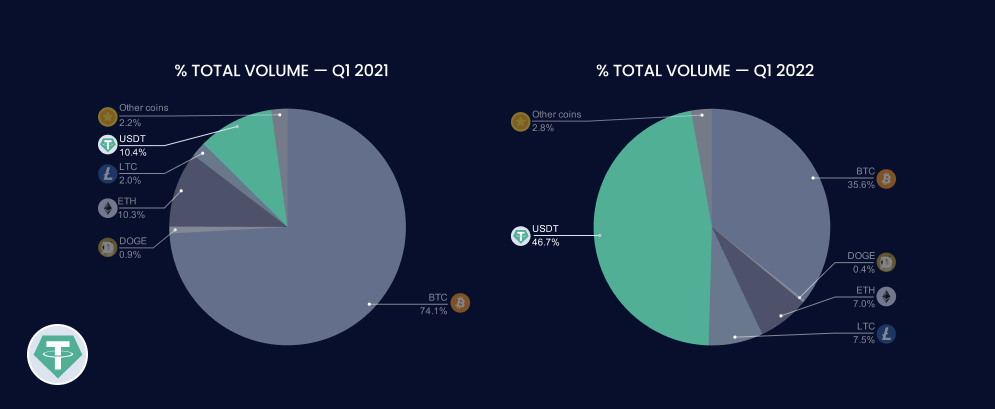

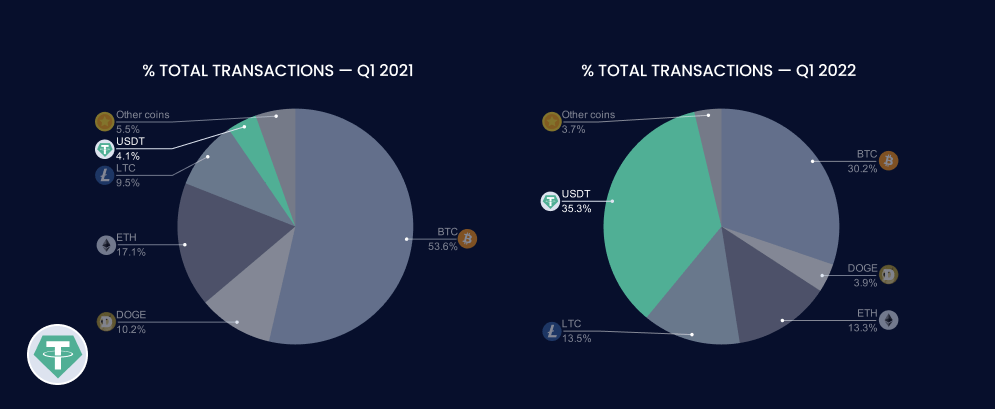

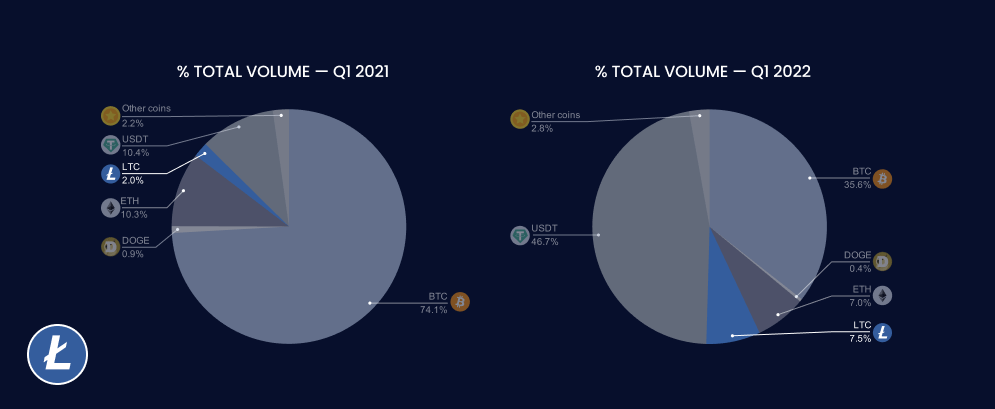

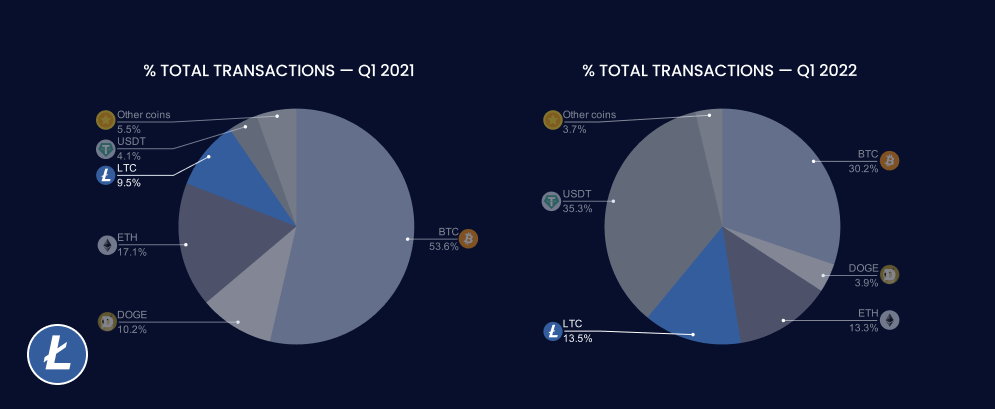

We have compared our total volume and the number of transactions performed in two periods: Q1 2021 and Q1 2022.

In both periods, and throughout 2021, the most commonly used cryptocurrencies for payments by consumers are the following:

However, let’s take a look at the comparative charts for both periods. This will give us an overview of how each currency has performed, both in terms of volume and number of transactions.

Designed by the pseudonymous Satoshi Nakamoto in early 2009, Bitcoin is a peer-to-peer electronic cash system whose currency is bitcoin (BTC), the first cryptocurrency in history.

It is a type of currency based on blockchain technology, 100% digital, divisible, fungible and scarce (as there will only be 21 million bitcoin in existence).

A censorship-resistant asset that can be sent, received and stored without depending on third parties, such as governments or central banks.

Its revolutionary properties, as well as its leadership in terms of market capitalization, have made it the most widely used cryptocurrency for payments for more than a decade. At least, it has been so until 2021.

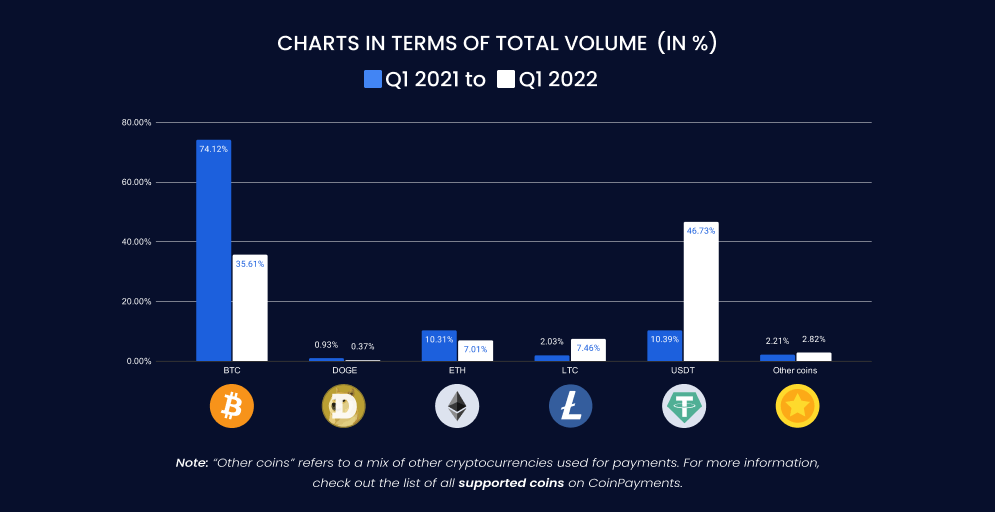

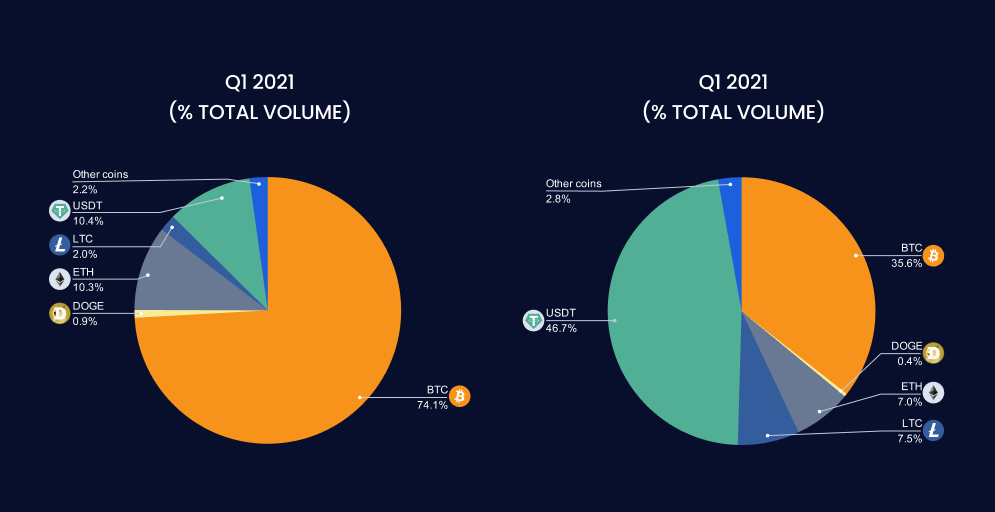

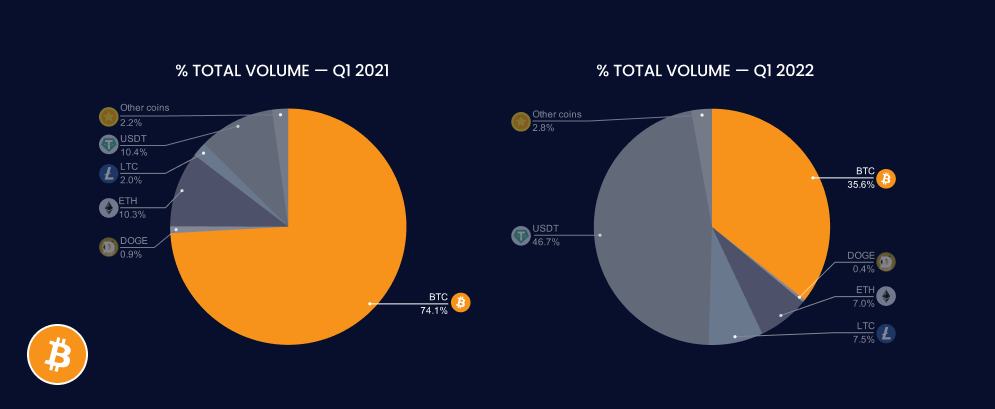

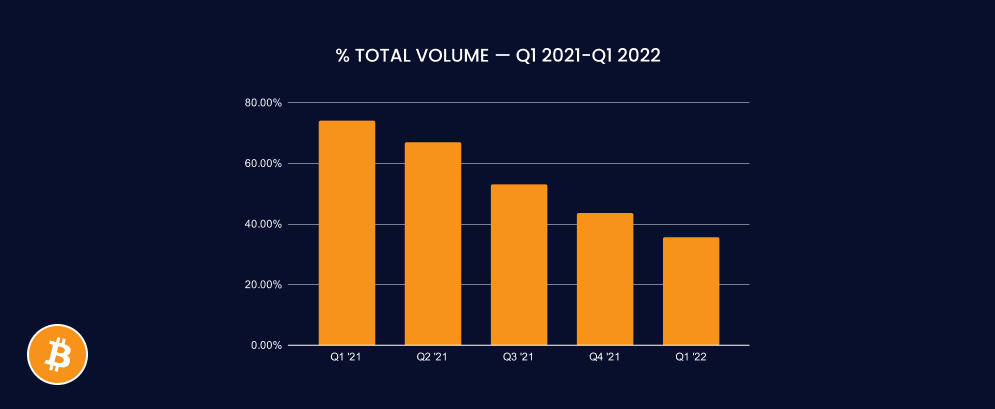

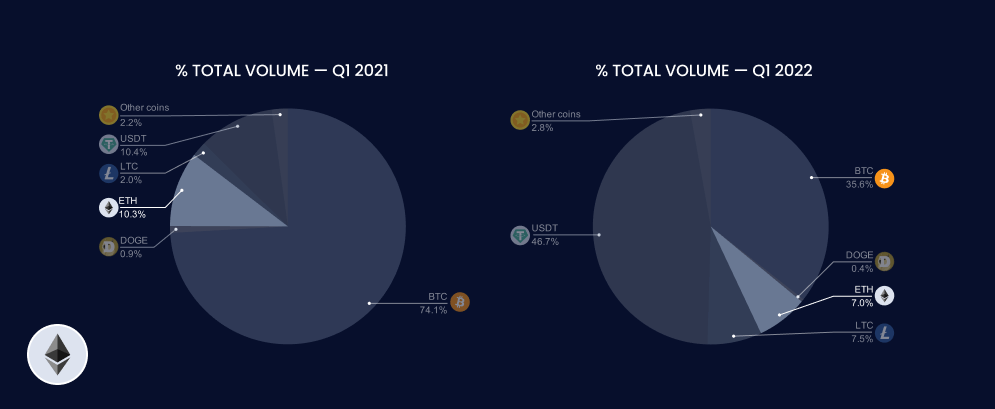

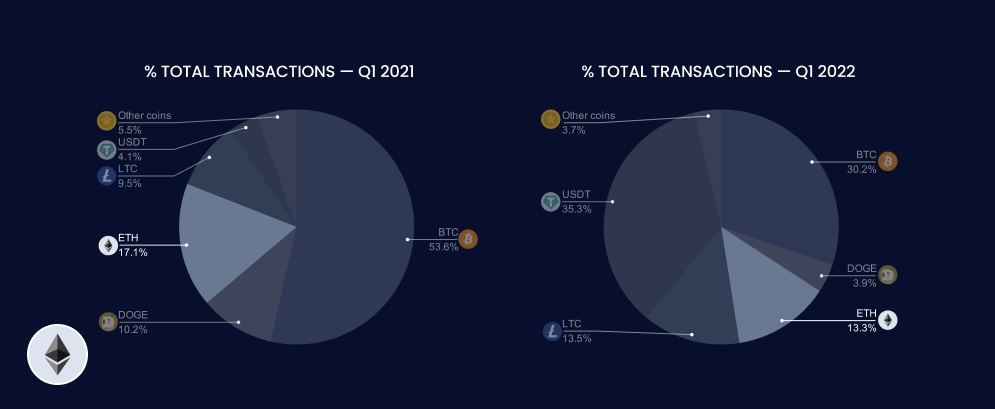

In the first quarter of last year, Bitcoin accounted for almost three-quarters of the total volume processed by our platform (exactly 74.1%). However, at the beginning of 2022, it has reduced its position to 35.6%, which is almost a third of the total volume.

In a single year, its share of our total transacted volume has dropped 38.5 percentage points. This shows how Bitcoin is maintaining a downward trend and losing its largely dominant position in recent years.

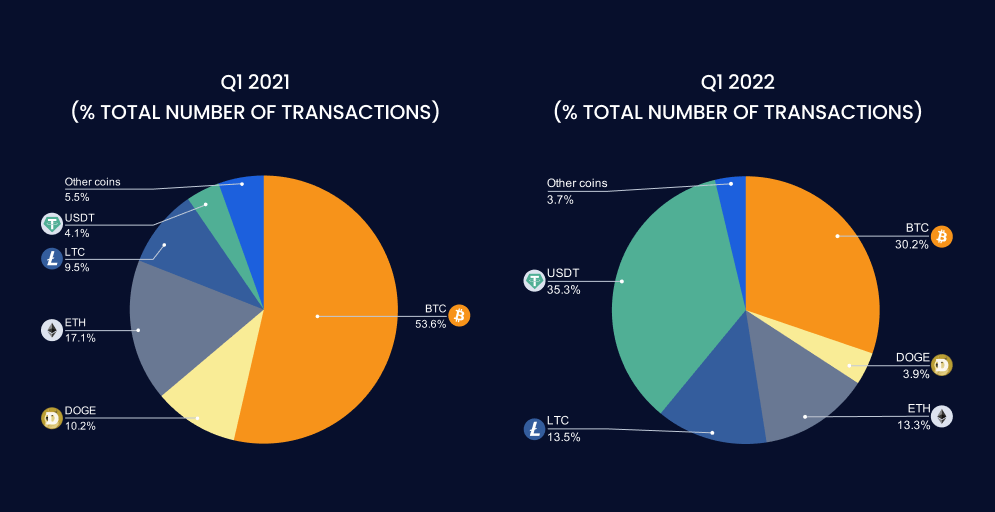

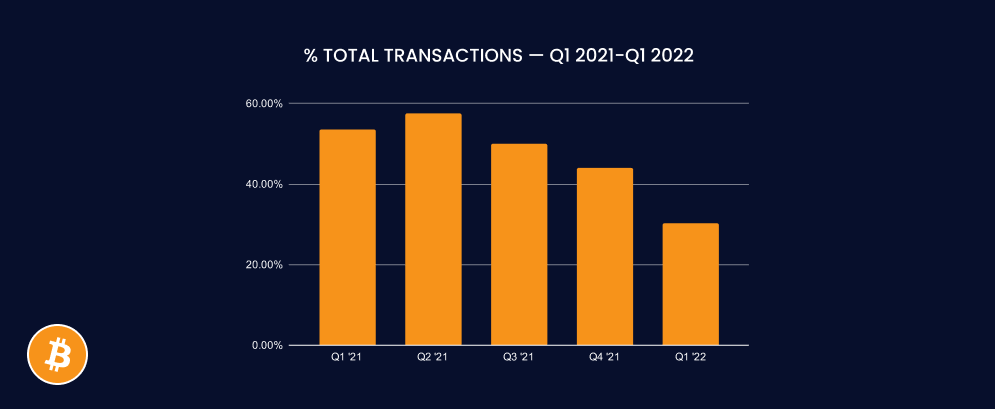

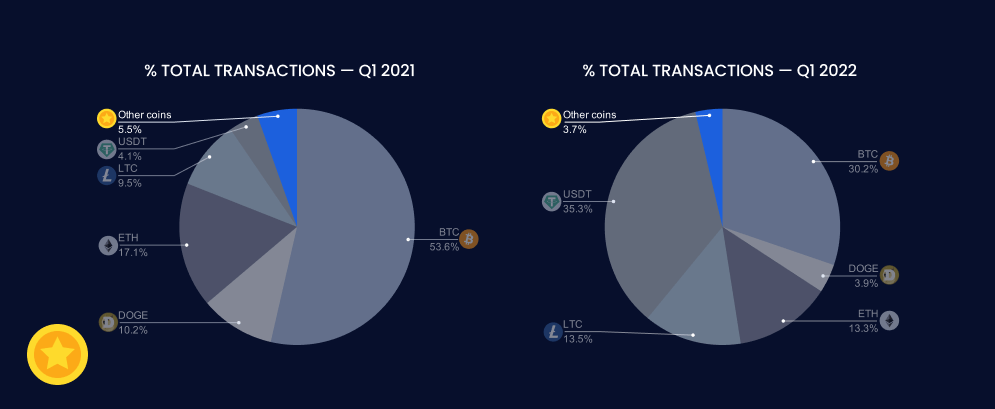

The same applies if we analyse the number of transactions made with Bitcoin in the last year.

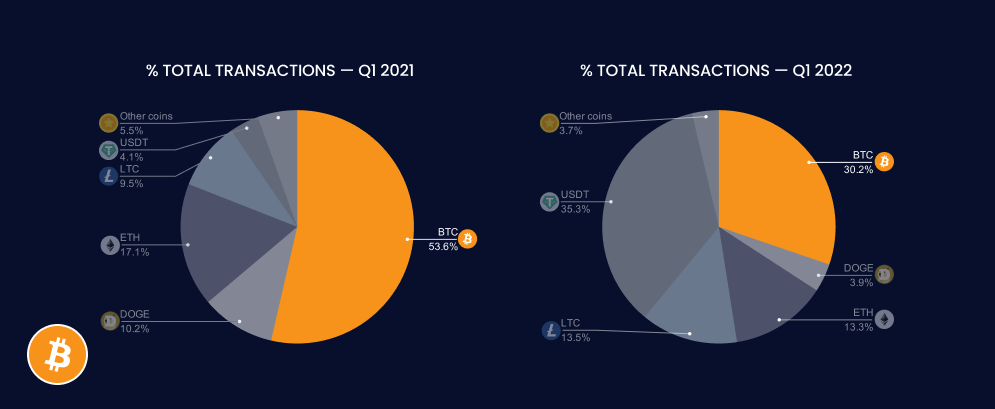

At the beginning of 2021, BTC represented 53.6% of all cryptocurrency transactions on CoinPayments. This percentage has been reduced to 30.2% during the first quarter of 2022.

However, in spite of this 23.4% drop in the number of transactions, Bitcoin remains among the top 5 most used coins for crypto payments in 2022.

Everything suggests that customers have decided to stop spending their precious and scarce Bitcoin in favour of other cryptocurrencies more akin to their well-known fiat currencies, such as Tether.

Launched as RealCoin in July 2014 and renamed 4 months after, Tether (USDT) is the most popular of the so-called stablecoins: cryptocurrencies whose aim is to keep their market valuation stable.

Tether belongs to the group of stablecoins collateralized with fiat currency. Specifically, a Tether token is pegged to the US dollar and maintains a 1:1 ratio with the dollar in terms of value (1 USDT = 1 USD). This is possible thanks to its reserves, which are a mix of cash, secured loans, US Treasury bills, and other investments.

Tether was specifically designed to provide the necessary bridge between fiat currencies and cryptocurrencies, offering stability, transparency, and minimal transaction costs to users.

For this reason and for being one of the pioneers of its kind, Tether has become not only the #1 stablecoin on the market, but also the preferred cryptocurrency for payments.

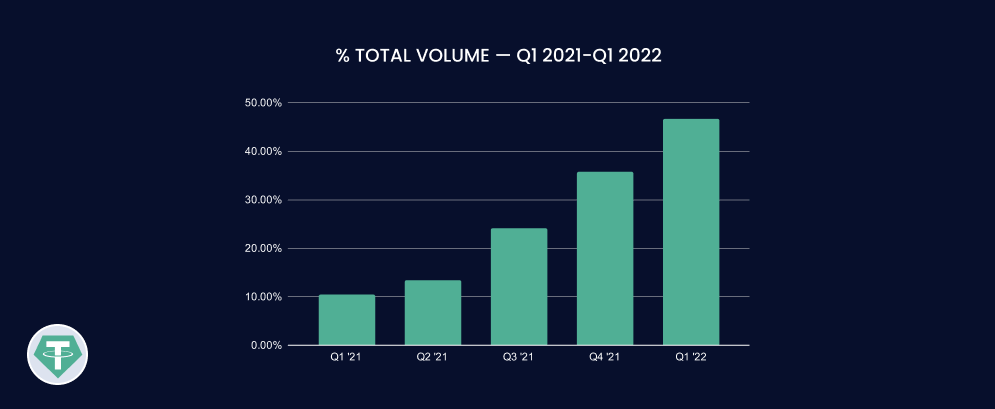

USDT went from representing more than a tenth of the total volume at the beginning of 2021 (10.4%) to account for almost half of CoinPayments’ transaction volume in the first quarter of 2022 (46.7%).

This represents an increase of 36.3% of the total volume managed on the platform. Average growth of 9% per month has led to it displacing Bitcoin as the cryptocurrency with the highest volume transacted on the platform in 2022.

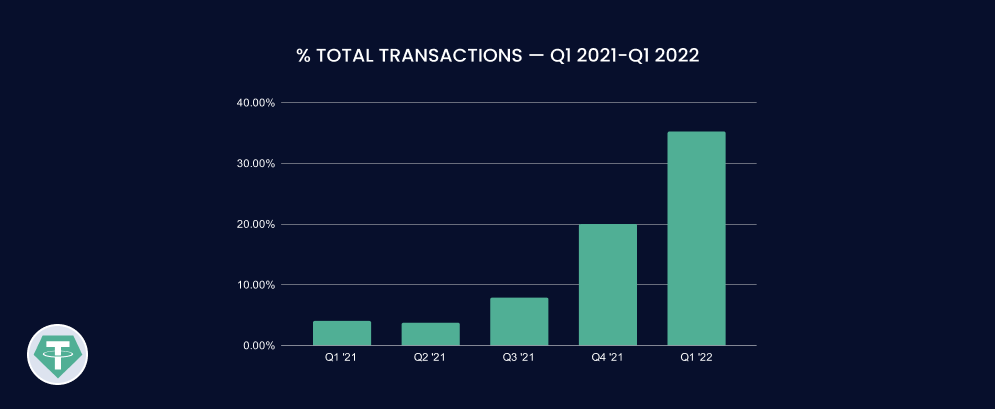

These figures are linked to the number of transactions made with this stablecoin, which has increased from just 4.1% of transactions in Q1 2021 to 35.3% in Q1 2022 (8.6 times more).

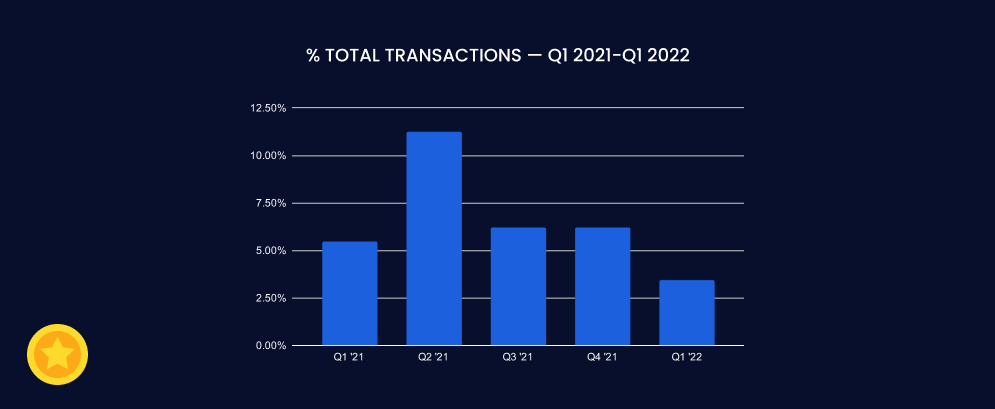

Apart from a significant rise in the number of transactions, what we can also observe is that this increase occurred mainly during the last quarter of 2021 and the first quarter of 2022.

As the bar chart shows, Tether went from accounting for 20% of all transactions in Q4 2021 to 35.32% in Q1 2022.

The figures show a trend change in both merchant acceptance of this specific cryptocurrency and consumer payment preference.

Where Bitcoin used to take up the vast majority of transactions and volume, it now seems that more customers prefer to pay with the stablecoin Tether.

Despite this, there are also many others who prefer to pay with other cryptocurrencies, such as Ethereum.

Conceived by Vitalik Buterin in 2013 and launched by him in collaboration with Gavin Wood in July 2015, Ethereum is a decentralized blockchain-based software platform that enables smart contracts.

Ethereum allows any type of decentralized application (dApp) to be built and programmed on it: from decentralized organizations (DAOs) to financial services (DeFi), non-fungible tokens (NFTs), games, and many more.

For this purpose, it also has its native token, the Ether (ETH), which serves both to interact with Ethereum applications and to be stored, sent, or received as payment for goods and services.

For several years this cryptocurrency has been the second largest cryptocurrency in market capitalization after Bitcoin (and just ahead of Tether, the third). For this reason and its multiple possibilities, it remains one of the 5 most used currencies in crypto payments.

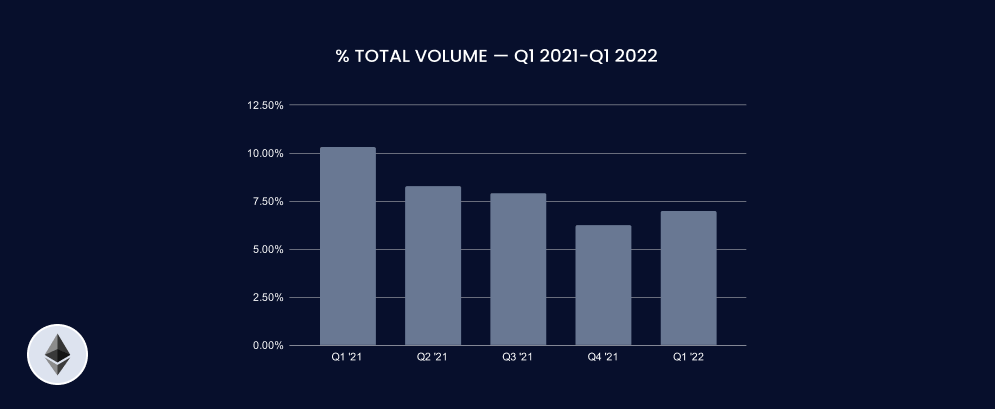

At the beginning of 2021, ETH accounted for 10.3% of the total volume registered on CoinPayments, virtually equal to Tether (USDT) at 10.4%.

However, unlike what has happened with the stablecoin, which has grown exponentially, ETH has slightly reduced its position in total volume, registering at 7% (a 3.4% decrease).

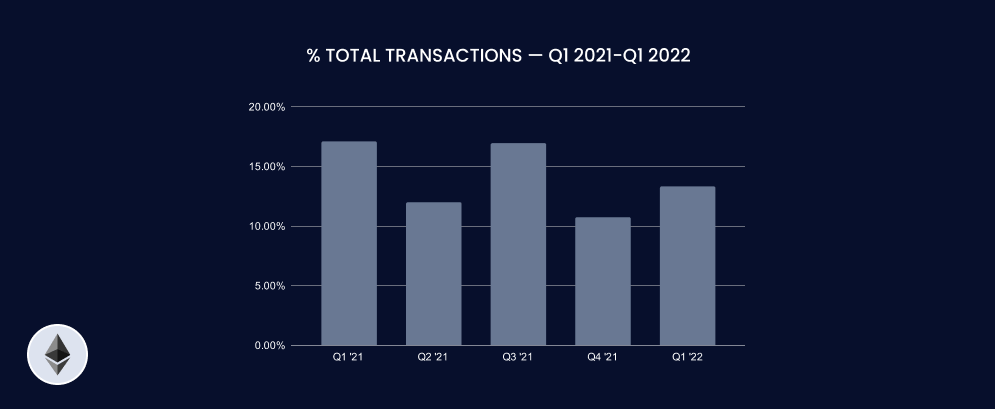

In terms of the number of transactions made with ETH during the first quarter of 2021, the token was the second most used, only behind Bitcoin, with 17.1% of total transactions.

In the same period of 2022, ETH accounted for 13.3% of all transactions made on CoinPayments (3.8% less than in 2021), falling to 4th place in our top 5 coins.

On the other hand, if we look at the bar chart, we can perceive a curious pattern: the number of transactions goes up and down from quarter to quarter. This may be due to the variable price of gas: the fee to be paid for making transactions on the Ethereum network.

When the network is not saturated, the price of making transactions remains affordable. However, when the number of transactions on the network increases considerably, the price of gas skyrockets, making it considerably more expensive to make a payment with ETH.

Despite this, ETH remains among the top 5 most used cryptocurrencies for crypto payments in 2022. However, due to this instability in the fees for paying with ETH, many consumers prefer to pay with other coins such as Tether, Bitcoin, or even Litecoin.

Founded in 2011 by a former Google engineer named Charlie Lee, Litecoin (LTC) is a peer-to-peer electronic cash system that was born from a fork of the Bitcoin blockchain.

Both projects are very similar. In fact, in essence, and explained by its own creator, Litecoin is a “lite version of Bitcoin” and its native currency, the LTC, “a currency that is the silver to Bitcoin’s gold”.

Nevertheless, Litecoin differs from Bitcoin in some details such as the maximum supply of coins (84 million, versus Bitcoin’s 21 million) or a higher transaction processing speed (2.5 minutes versus bitcoin’s 10 minutes).

This last property allows making payments in LTC 4 times faster than with BTC, being one of the compelling reasons why Litecoin is among the 5 most used cryptocurrencies in crypto payments in 2022.

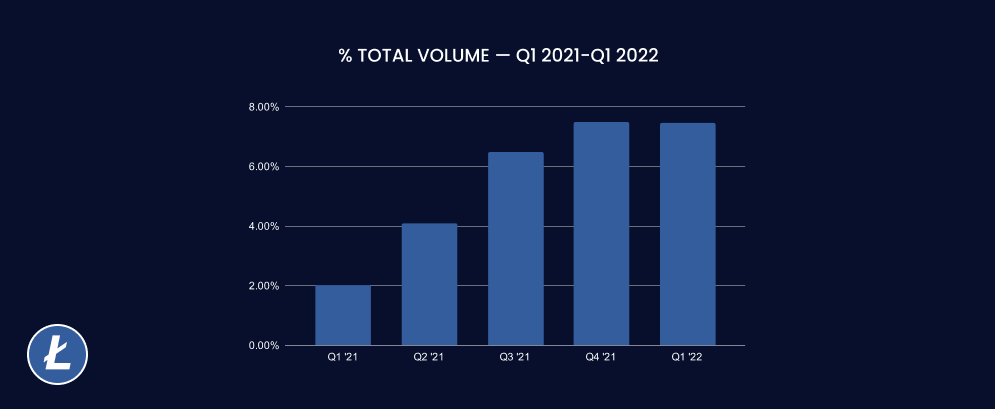

In terms of total volume, it is far behind the other currencies mentioned above. Even so, its volume has grown in the last year.

In the first quarter of 2021, LTC accounted for only 2% of the total volume. One year later, it has almost tripled its share, accounting for 7.5% of the total.

Its highest volume growth occurred in 2021. From January to December of last year, Litecoin increased its volume 2.69 times, as the bar chart shows. However, during the first quarter of 2022, it has slightly reduced its position.

Along the same upward trend are LTC transactions, which have risen from 9.5% of the total in early 2021 to 13.5% in Q1 2022 (a 4% increase).

Now, although the trend in 2021 is upward, the number of transactions made with LTC has declined so far in 2022: from 17% in Q4 2021 to 13.45% in Q1 2022 (a decrease of 3.5%).

Overall, the use of Litecoin for crypto payments has not only been maintained but has grown compared to the previous year.

We will have to wait for future months to see how it performs, but all indications are positive that it will remain among the top 5 most used currencies in CoinPayments.

If Litecoin was a fork that emerged from the Bitcoin blockchain, Dogecoin (DOGE) is a fork that emerged from the Litecoin blockchain.

Launched in December 2013 and created by software engineers Billy Markus and Jackson Palmer, Dogecoin is the first so-called meme coin.

Its creators decided to create a payment system as a joke, making fun of Bitcoin and the wild speculation on cryptocurrencies in 2013. In fact, its name and logo come from a popular meme at the time that used the deliberately misspelt word “doge” to describe a Shiba Inu dog.

However, against all odds, Dogecoin has been gaining popularity in the crypto community and as a means of payment.

Among its biggest supporters are personalities such as Elon Musk, Snoop Dogg, Mark Cuban, or Jake Paul, and companies like the Dallas Mavericks, SpaceX, AMC Theaters, or Newegg accept it as a payment method.

Dogecoin has proven that it is not a joke but a serious project, remaining one more year in our top 5 cryptocurrencies.

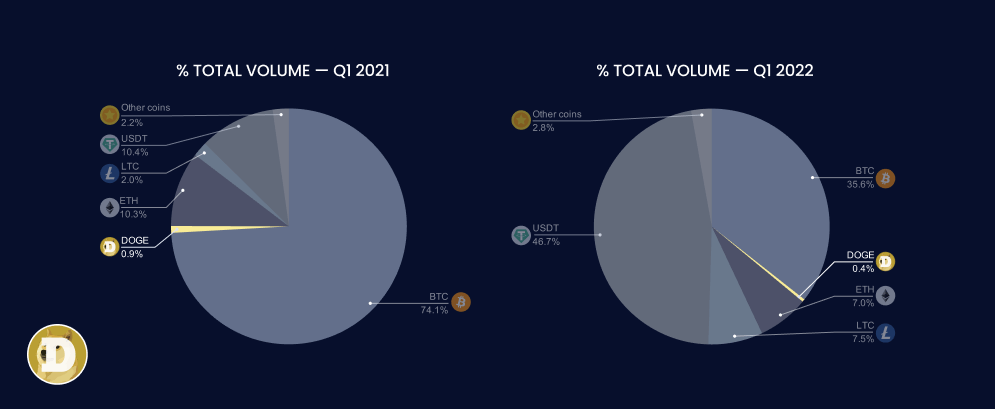

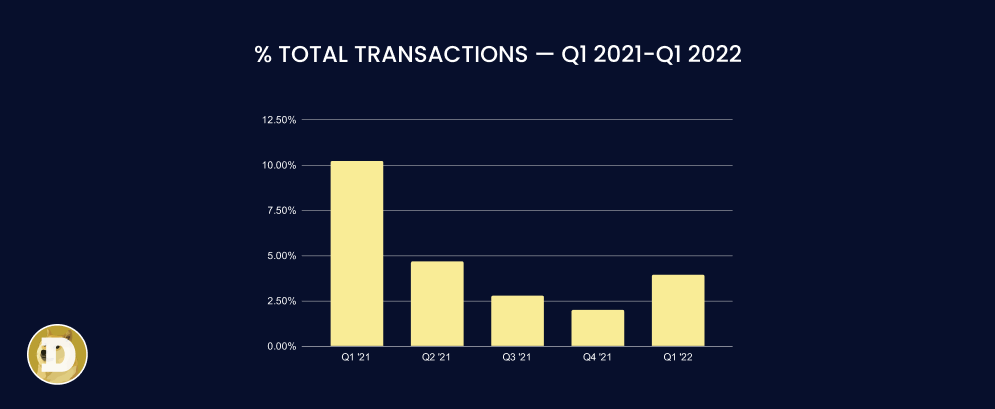

In terms of transaction volume, DOGE represents the smallest of the 5 most used cryptocurrencies in payments.

In the first quarter of 2021, DOGE was handling only 0.9% of total volume, a figure that dropped by more than half one year later to 0.4% in early 2022.

Its highest record was in Q2 2021 when it accounted for almost 1.5% of total volume. However, since that quarter a considerable decline can be noted.

In terms of transactions, it is interesting to mention that at the beginning of 2021, more payments were being made with DOGE than with LTC, especially compared to USDT, the cryptocurrency with the highest number of transactions at this moment.

10.2% of all transactions made on CoinPayments during the first quarter of 2021 were made with DOGE, versus 9.5% of LTC or 4.1% of USDT.

Much has changed in the first quarter of 2022, where it has been relegated to fifth place with only 3.9% of the total transactions.

Despite the decline, so far in 2022 more transactions are taking place in DOGE than in the previous two quarters, confirming its slight rise since mid-2021.

Regardless of the reduction in both volume and number of transactions compared to the previous year, Dogecoin remains one of the top 5 most used cryptocurrencies in crypto payments.

And taking into account the number of companies that accept it as a means of payment, everything indicates that it will become more important over time.

The “other currencies” group includes all those cryptocurrencies which are used to make payments, but whose total volume does not represent individually more than 1%.

Among many of them, the most representative coins in this group are Bitcoin Cash (BCH), Binance Coin (BNB), Velas (VLX), Ripple (XRP), and other stablecoins such as BUSD, USD Coin (USDC) or TrueUSD (TUSD).

You can check all CoinPayments’ supported coins on this link: https://www.coinpayments.net/supported-coins

Together, these cryptocurrencies accounted for 2.2% of the total volume registered on CoinPayments at the beginning of 2021, slightly ahead of Litecoin (2%) and Dogecoin (0.9%).

In the first quarter of 2022, this group’s volume rose slightly to 2.8% of total volume, surpassing only DOGE (0.4%).

However, this slight increase of only 0.6% in one year does not represent what happened quarter by quarter, as can be seen in the bar chart.

If we only take into account the last 3 quarters of 2021, we see that this group accounted for between 5% and 8% of the total volume. One of the reasons for this rise could be the increase in popularity of other stablecoins, related to the huge growth of Tether (USDT) as a means of payment.

These figures are very different from those found in the first quarters of both years (2.21% in Q1 2021, and 2.82% in Q1 2022, respectively).

During the first quarter of 2021, this group of mixed coins accounted for 5.5% of all transactions conducted on CoinPayments, collectively surpassing the stablecoin Tether at 4.1%.

But just as what happened with the volume transacted, the number of transactions made by this set of currencies decreased slightly at the beginning of 2022, representing only 3.7% of the total.

Excluding the second quarter of 2022, the trend for transactions in other currencies outside our top 5 is downward.

Data shows that both customers and merchants prefer to use more established cryptocurrencies in the market, such as the ones in our top 5.

Even so, and despite the downward trend, it seems likely that there will continue to be a niche for those who want to pay with other digital currencies in the future.

Below, we are going to summarize in 7 points the most important facts about the 5 most used cryptocurrencies for crypto payments.

BTC has lost strength compared to the rest of the top coins used for payments, especially in favour of USDT.

Nevertheless, despite the significant decline, it remains the second most used currency on CoinPayments, both in terms of volume and number of transactions.

Tether (USDT) has become the big winner so far in 2022, increasing its position to reach the top 1 most transacted currency on the platform.

That shows the preference of merchants and customers for stablecoins, especially USDT.

Between BTC and USDT together, they account for 82.3% of the total volume and 65.5% of the number of transactions made in early 2022.

This illustrates the prevailing willingness of merchants to accept payments mainly in these two cryptocurrencies.

ETH has lost ground as a currency for crypto payments compared to the previous year, possibly due to high and volatile fees on its own network.

However, it still remains one of the most widely used cryptocurrencies in commerce.

Along with USDT, LTC has been one of the winners of 2022, almost quadrupling its volume in a single year.

This shows that Litecoin is also chosen by thousands of merchants as a good currency for crypto payments.

Dogecoin is still the coin with the lowest volume and the lowest number of transactions among our top 5.

However, due to its growing popularity within the community and its recent acceptance in large businesses, it is possible that 2022 could be a good year for this cryptocurrency.

Among the rest of the cryptocurrencies outside the top 5, the trend shows that customers prefer to pay with more solid and established digital currencies such as Bitcoin, Tether, Ethereum, Litecoin, or Dogecoin, all of them with over 8 years in the crypto market.

Still, year after year, customers continue using other coins to buy goods and services, something that seems likely to continue through 2022.

It is no longer a secret to anyone: cryptocurrencies are becoming more and more established as a means of payment globally, both among companies and in countries.

While in 2021 El Salvador was the first country to accept Bitcoin as legal tender, so far in 2022, a second country has already joined the trend: the Central African Republic.

Small and large companies alike are headed in the same direction. According to a study* conducted by Visa, 25% of small businesses in 9 countries plan to accept crypto payments by 2022.

Brands such as Gucci have already taken the step to accept crypto this year, and other major players such as Airbnb, eBay, Amazon, and Uber have already hinted that they will do so in the near future.

All this data shows the rise of cryptocurrencies as a means of payment, largely thanks to the benefits they bring to users, companies, and countries.

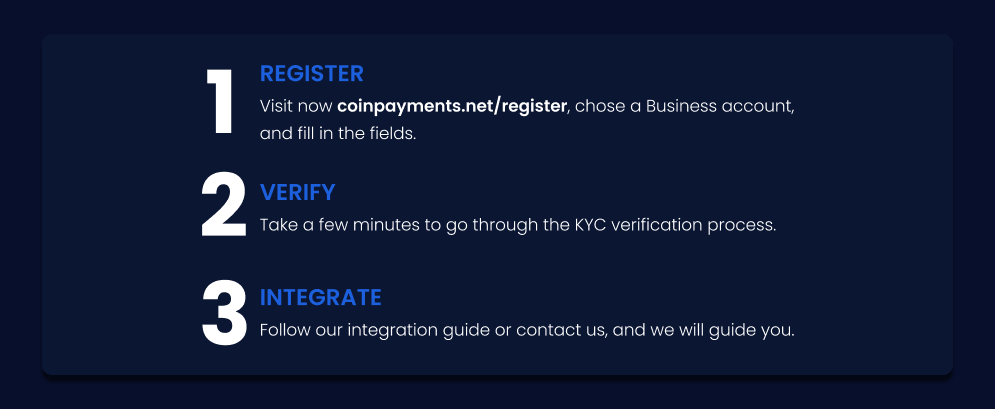

Contrary to what it may seem, it is very easy to accept crypto payments, especially with complete solutions like CoinPayments. Here we show you how to do it in 3 simple steps:

Our crypto payment gateway allows you to accept payments in Bitcoin, Tether, Ethereum, Litecoin, Dogecoin, and up to 120 other cryptocurrencies. All this, maintaining one of the lowest transaction fees in the industry—only 0.5%.

Follow in the footsteps of more than 117,000 merchants in over 190 countries who are already using CoinPayments.

Register now for your free Business account and start enjoying the benefits of crypto payments today.

Click here and visit our Issuu profile to enjoy the full report.